Planned Giving

Tie Your Personal Legacy to President Lincoln’s Legacy

Ford’s Theatre explores the legacy of President Abraham Lincoln and celebrates the American experience through theatre and education. Planned gifts from forward-thinking donors ensure that Lincoln’s values will be preserved to benefit those who follow. We understand that a planned gift is one of the most personal commitments you can make and we appreciate your consideration.

When you include Ford’s Theatre Society in your estate planning, you become a member of the distinguished Lincoln Legacy Circle, a group of caring donors sustaining Ford’s Theatre as a national treasure and ensuring Lincoln’s vision for the nation is shared with future generations.

Your planned gift will provide important resources and support:

- learning experiences for nearly one million visitors each year, including more than 250,000 school students;

- student and teacher education through historical programming, field trips and interactive museum exhibits;

- live theatre for approximately 100,000 people each season including many who experience it for the first time through our free ticket programs; and

- immersive educational offerings, such as the National Oratory Fellows program, virtual field trips and Summer Teacher Institutes.

Whether it is a bequest, trust, life insurance proceeds or an arrangement made through your retirement plan, planned gifts of all sizes support Ford’s Theatre long-term and often provide financial benefits to you as well.

No minimum-gift requirements are set by Ford’s Theatre, as gifts of all sizes impact Ford’s future. Your financial advisor can recommend a planned-giving instrument that is best for your charitable goals.

For more information about Lincoln Legacy Circle membership and how to tie your legacy to Lincoln’s, contact the Development Department at (202) 434-9552 or [email protected].

The Honor of Leaving a Legacy

An Inaugural Lincoln Legacy Circle member shares why he values Ford’s Theatre.

I first attended performances at Ford’s Theatre in the 1980’s. My relationship deepened in the late 1990’s when my daughter was a small child. We had already introduced her to A Christmas Carol through several versions on videotape. Ever since then, we have attended Ford’s performances of A Christmas Carol almost every holiday season.

As our attendance developed into a family tradition, I was inspired to support Ford’s through an annual donation. Later, I became a recurring donor. When I amended my will to add gifts to those organizations that I strongly support, Ford’s was an obvious choice to be included.

Although A Christmas Carol was the original impetus for my support of Ford’s, over the years I have gained a greater appreciation of the overall impact of Ford’s work and of the importance of Lincoln’s legacy to the nation. The challenges Lincoln faced have become even more relevant in our own time, and awareness of them has been advanced by the content of Ford’s dramatic offerings as well as the museum and written materials.

Today, more than ever, I see Ford’s mission to be to broadcast Lincoln’s positive message of tolerance and respect. Theatre productions are promoting this mission in innovative yet nonpolitical ways to a wide audience, while the development of programs such as the Abraham Lincoln Institute brings exploration of these important issues to venues outside that of the performing arts. I hope that my support will aid these initiatives now and in the future.

I am very proud that my support through donations, as well as my planned gift to Ford’s Theatre, will forever tie my personal legacy to Lincoln’s legacy. I consider this to be a great honor. I would say to those who believe that they’re not “old enough” or “rich enough” or “financially savvy enough” to make a planned gift, that a commitment of any type or size at any time gives them the honor and satisfaction of binding their own legacy to Lincoln and to the advancement of our nation that it represents.

Stanley T. Myles

Inaugural Lincoln Legacy Circle member

Why include Ford’s in your estate plans?

Two of our supporters share why they value Ford’s Theatre.

Several years ago, we attended an interview of Marvin Hamlisch, the pianist, composer and conductor at the Kennedy Center. Shortly after the lively dialogue began, a group of high school students was ushered into the hall so that they could hear about the life and the work of this musical legend. That student group’s inclusion in this event made a lasting impression upon both of us.

Fortunately, we both grew up with an exposure to the arts. Throughout the years we have both enjoyed and greatly benefited from our experience of live theatre. Theatre has enriched our lives by entertaining us, by introducing us to diverse cultures, by challenging us with new thoughts, and by comforting us with a vision of hope.

Knowing the value of the arts in our own lives, we were gratified to know that someone made the effort to arrange for that high school group to be exposed to the arts. In some way, we knew we wanted to bring that opportunity to others.

In a later interview he gave to The Washington Post, Hamlisch spoke about the need for arts education:

“A few years ago, I gave a speech at the National Press Club. The topic was ‘Arts Education in the Public Schools.’ Why arts education is so low on the totem pole of priorities baffles me. There have been studies that clearly state that children who are exposed to arts education at a young age will in fact do markedly better…”

As we prepared for our marriage a few years later, we undertook the process of planning our estate. We wanted part of our legacy to include those institutions who have a mission to bring the arts to the youth of our communities.

Since we had been donors to Ford’s Theatre, we asked to meet with the staff to discuss their educational outreach programs and how they intersected with our goals. We learned how Ford’s uses its resources to support teachers, to bring learning into the classroom both locally and across the country, to offer student matinees, to teach oratory to students, to keep the legacy of Lincoln alive.

It was an easy decision to include Ford’s in our estate planning. It was just as easy to make the arrangements to do so. You don’t need to be a certain age. You don’t need to be wealthy. You don’t need to be a financial wizard. You only need to believe in the value of the arts and to want to share that with others.

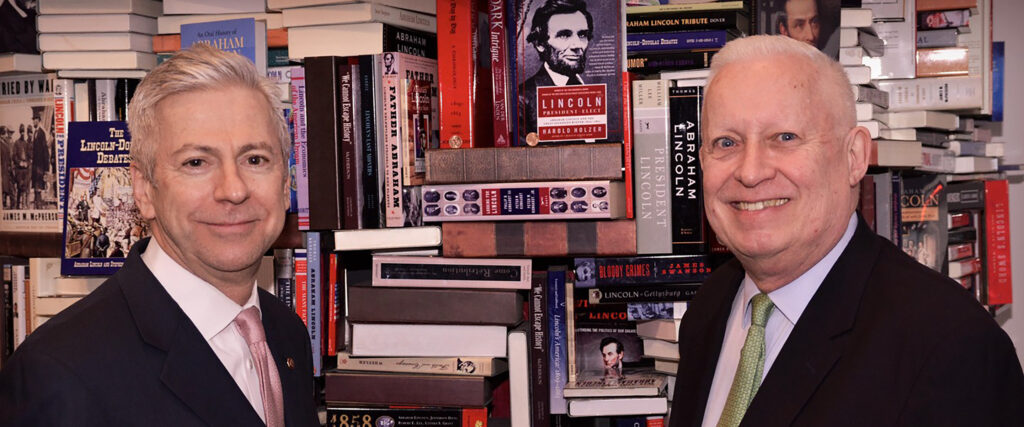

David Insinga and Bob McDonald

Once Ford’s Theatre Society receives your completed letter of intent, you become a member of the Lincoln Legacy Circle with full benefits of membership:

- You receive invitations to select events throughout the theatre season.

- You are recognized at an event honoring Lincoln Legacy Circle members.

- You are listed as a Lincoln Legacy Circle member in publications.

- You receive the Lincoln Legacy Circle newsletter.

- Your personal legacy is now a part of President Abraham Lincoln’s legacy.

For more information about Lincoln Legacy Circle membership and how to tie your legacy to Lincoln’s, contact the Development Department at (202) 434-9552 or [email protected].